Benefits of MERPs for Small Businesses

Table of Contents

Health insurance can be a significant expense for small businesses, but employers don't have to forego this competitive employee benefit to save costs. Instead, they can use a medical expense reimbursement plan to bridge the gap between offering nothing or a full-fledged health care plan. MERPs also bring other advantages besides helping employers afford to provide their workers with health coverage.

This guide explores how MERPs work, their benefits and when they can be an appropriate solution. We will also answer frequently asked questions about how these plans work for small businesses.

What Is a MERP?

A medical expense reimbursement plan is an employer-sponsored, IRS-approved health plan that offsets out-of-pocket healthcare costs for employees and their dependents. When administered correctly, paybacks may not be subject to payroll tax, employees can avoid paying income tax on medical costs and reimbursements might be deductible for employers.

MERPs are more flexible than other small business health insurance options, accommodating employers' specific needs while still benefiting everyone involved.

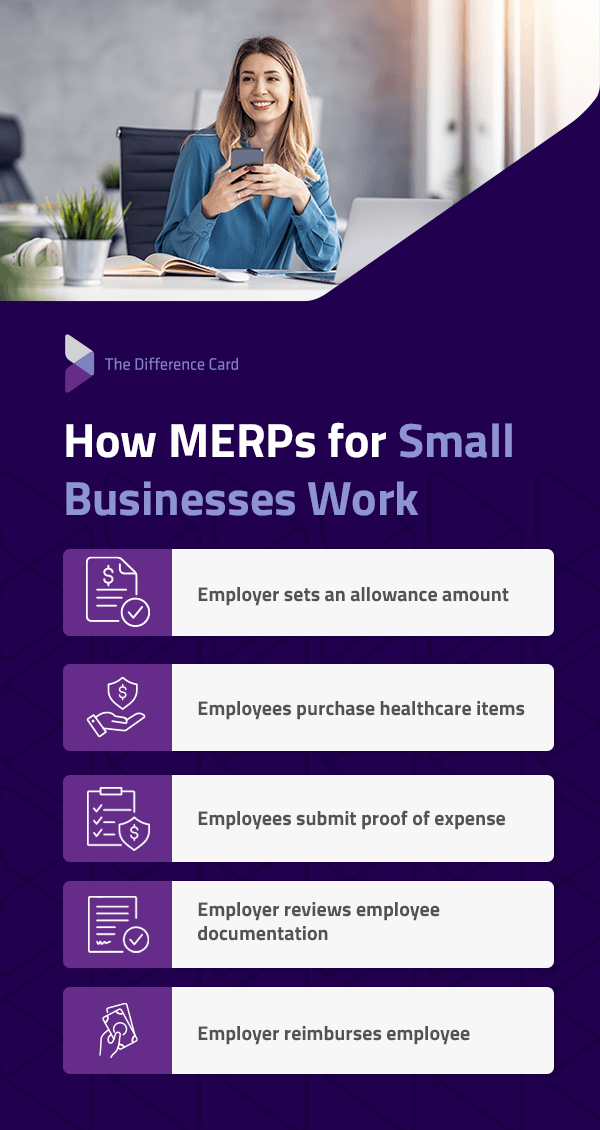

How MERPs for Small Businesses Work

MERPs follow a five-step proczess when handling health-related expenses in the workplace.

- Employer sets an allowance amount: The employer sets the maximum reimbursement amount each employee may receive for monthly healthcare expenses.

- Employees purchase healthcare items: In this step, employees choose providers, products and services to meet their individual or family health needs. In some cases, employees may also choose an individual health insurance policy according to their preferences.

- Employees submit proof of expense: Once employees make their healthcare purchase, they send proof of their qualified expenses, such as a detailed receipt, healthcare provider statement or explanation of benefits. This document should include the date of service, amount charged, description of service provided and the registered member's name.

- Employer reviews employee documentation: The employer or their designated plan administrator will then review the documents to verify healthcare costs are eligible for reimbursement under the MERP terms.

- Employer reimburses employee: The employer will reimburse the employee — typically through payroll — for eligible costs up to the approved allowance amount. The reimbursement is tax-free for the employee and deductible as a business expense for the employer.

-

How MERPs Differ From HRAs

Health reimbursement arrangements come in various forms, from integrated to individual coverage. While HRAs have some commonalities with MERPs, such as being tax-exempt for employees and tax-deductible for employers, they also have notable differences.

Unlike HRAs, MERPs allow for employee contributions. Employees can share some administrative costs with their employers to access plans that better relate to their needs, enabling employers to offer premium-level rates as an alternative to traditional insurance.

Additionally, while HRAs require employers or brokers to work with a medical insurer as part of the service offering, using MERPs with an outside administrator makes it easier to market health insurance plans at renewal.

12 Benefits of MERPs for Small Businesses

MERPs have many features that differentiate them from other health insurance for small businesses, like HRAs, flexible spending accounts and health saving accounts. Here are 12 benefits of these plans.

-

1. Numerous Reimbursable Expenses

MERP reimbursements can include any IRS-qualified medical expense, including individual health insurance policy premiums, coinsurance, deductibles and co-pays. These may vary from plan to plan, since employers may restrict reimbursable expenses as needed. Typical reimbursable items may include:

- Health insurance premiums

- Doctor's office visits

- Prescription drugs

- Hospital care

- Dental and vision expenses

- Emergency room or urgent care visits

- Over-the-counter medications

- Surgical procedures

- Physical therapy and acupuncture

2. Lower Premium Costs

Premiums for major medical and supplemental, Medicare and supplemental and qualified long-term care are tax-deductible, creating lower premium costs for employers. Companies can offer employees essential health coverage without taking a significant financial hit. A small business medical reimbursement plan can be a valuable option for companies already offering superior benefits, as it comes at a lower cost while preserving exceptional coverage for employees.

3. Efficient Use of Funds

In contrast to traditional insurance plans, where the insurance provider keeps unused premium funds for the year, MERPs let employers keep unspent funds and roll them over to the following year's benefits program. MERPs also allow businesses to set more accurate annual limits based on data insights. For instance, the provider might keep a complete claims history so employers can access and identify trends to optimize benefits and maximize savings.

4. Employer Tax Advantages

MERPs allow businesses to deduct 100% of employees' health insurance costs, such as medical expenses and premiums, from taxable amounts. These deductions are also not subject to 7.5% itemized deduction rates like other health plans, reducing the overall cost of employee benefits. Employee contributions are not subject to payroll taxes, helping the employer gain additional savings.

5. Employee Tax Benefits

Reimbursement amounts for MERPs generally do not count as gross income, allowing people to pay medical expenses through the reimbursement plan with pretax dollars. Because MERP reimbursements are not wages, they are not subject to Federal Unemployment Tax Act and Federal Insurance Contributions Act taxes. Employees’ out-of-pocket costs are 100% deductible, adding an extra layer of financial security to healthcare costs.

6. Flexible Spending and Coverage Options

While a smaller employer group under one carrier might have a limited menu, MERPs allow employers to design their plan offerings and change them annually. Businesses can customize plans to specific employee preferences and needs, retaining top talent and boosting morale.

It also helps employers optimize their yearly budget rather than purchasing a set plan with options their employees may not use. Researching which medical expenses are most frequent before designing a plan may also help.

7. Defined Contribution

Employers may combine a MERP with an insured medical plan to form a fixed contribution strategy the company and employees can steadily benefit from for years. Doing so may help employees pay for medical services not covered by the company's healthcare plan, such as dental or vision. It limits risks while encouraging employees to prioritize their physical well-being.

8. Rate Stability

Pairing a MERP with a less expensive insurance plan may maintain rate stability at renewal times. This perk is significant, considering other health plans are less consistent.

9. Partial Self-Insurance

MERPs allow employers to self-fund part of their medical benefits while limiting risks. For instance, employers may offer to cover a percentage of medical expenses, while the employee contributes the rest of the payment. Bundling the MERP with a high-deductible group health plan is an even better advantage because it decreases the cost of offering healthcare benefits and reduces the employer's tax liability. The employer pays the difference between the deductible and the employee allowance to reduce fixed costs.

10. Wellness Incentives

MERPs' flexibility in designing custom plan offerings allows employers to build incentive-based plan designs to achieve company objectives. For example, this may include offering a wellness program with valuable incentives to promote healthy practices that reduce long-term healthcare costs.

11. Detailed Use Data

When large employer groups are under one broker, it can be challenging to gauge the claims experience for some health insurance plans due to pooling arrangements and their size. With MERPs, employers gain full access to their employees' detailed use data.

12. Reduced Administrative Needs

Other health insurance plans for small businesses might require employers to verify and approve medical expenses and reimbursement. MERPs often have a designated administrator who handles these processes on the employer's behalf and maintains compliance with plan rules, letting employers remain focused on their core business operations.

When a Company Should Use a MERP

Consider the following questions when deciding whether a MERP suits a particular small business.

- How many employees need medical coverage? If most employees have dependents, they may prefer a more robust medical reimbursement plan.

- Are employees happy with their current medical coverage? Employers should evaluate plan usage and send surveys asking employees if the existing coverage meets their needs. It can also help to compare the current benefits package with potential MERP offerings.

- How expensive is outside health insurance for employees? Considering how much employees pay for premiums is another way to determine whether the MERP can cover core medical expenses.

- How easily can employees obtain health insurance in the marketplace? Can the company's employees research and buy an outside health insurance plan?

- What types of insurance can the business afford? MERPs are often a valuable option for small businesses because they are more affordable than other health insurance plans. It might also benefit companies with premium coverage offerings looking for a more affordable alternative with tax benefits.

- Do other businesses in the same industry offer health insurance to employees? Top talent may gravitate toward companies with robust health insurance benefits. Check competing companies' offerings to find similar coverage that maintains or improves their ability to attract and retain workers.

- Does the employer have the time and resources to establish an electronic system for MERP reimbursements? Before proposing a MERP to a company, find out if it has the finances, time and administrative support to maintain it and adjust the plan to match the company's needs.

MERP Frequently Asked Questions

There are some misconceptions about MERPs. Here are a few answers to expand your knowledge of these plans for small businesses.

Do MERPs Cover Family Members?

MERPs usually cover an employee's family members, such as spouses and dependents. Still, it depends on a particular MERP's specifics. For example, the plan may define who qualifies as a dependent, how much it covers and what coverage is available to them.

Are All Medical Expenses Eligible for MERP Reimbursement?

As mentioned earlier, MERPs only cover IRS-qualified medical expenses. Employers are also free to exclude some reimbursable expenses from their MERP based on collective employee needs and company financial capabilities.

What Happens to Unused Funds in a MERP?

Depending on the plan design, unused MERP funds may revert to the employer or roll over to the next year. The MERP documentation typically outlines this. Employers and employees should review the policies carefully to understand their plan's specifics.

Are There Contribution Limits for MERPs?

While the minimum monthly contribution is $75, there is no maximum contribution level, allowing employers to offer as much as they see fit for their employees' unique needs. However, management-level employees may not contribute more than non-managerial staff.

Which Industries Are MERPs Particularly Beneficial for?

MERPs can benefit companies with fluctuating, inconsistent health insurance needs, such as seasonal businesses and tech startups. These plans provide flexible coverage and allow employees to choose health policies that work for them.

Explore the Benefits of MERP Solutions With The Difference Card

MERPs' many benefits make them an excellent option for brokers to offer clients and a solution for employers and employees who value cost savings and flexibility. The Difference Card helps organizations build cost-effective MERP healthcare plans with optimal employee benefits.

To ensure our unique plan designs benefit brokers offering MERP solutions to their clients, we assign a dedicated account executive to assist you with annual financial projections and developing a communication plan. Employees may also contact our customer service line for more detailed and knowledgeable responses to any questions. To leverage MERP solutions from The Difference Card, request a proposal from us today.