What are Your Benefits Really Worth?

Table of Contents

Whether you are interviewing for a new position, have started a new job or are seasoned at your company, knowing what your benefits are really worth is important and advantageous. This knowledge equips you with a powerful tool as you progress in your career.

Many employees curate benefit packages to attract and retain new talent, so understanding what benefits are worth can help you choose between potential employers and give you the insight you need to negotiate a good package.

Employee Compensation and Benefits

While your compensation and benefits are linked, they are also two separate offers. Your compensation includes your wages, salary, commission, stock options and overtime.

Your benefits are non-monetary and include pension plans, health insurance and vacation time. Additional benefits can also include perks like wellness programs, stipends, access to your workplace's gym and discounts at your workplace's coffee shop. Employers will often include your benefits in your total remuneration. Benefits make up 30% of the average person's paycheck.

What Makes a Good Benefits Package?

You have a package, but are your benefits good? When evaluating your package, look for these key components to determine if you have comprehensive benefits:

- Paid time off

- Health insurance

- Retirement savings plans

- Unemployment insurance

- Ancillary benefits, such as disability insurance, life insurance and dental coverage

Depending on your income, some employee benefits are required by law, including Social Security, unemployment insurance, healthcare and workers' compensation. Other benefits are not required, and you may have to contribute financially toward these secondary or ancillary benefits.

How Much Are Employee Benefits Worth?

Benefits are non-financial — you do not get their value in cash — but that does not mean they do not have monetary value. Some benefits, like your health insurance package, have a more obvious monetary value than others, like a work-life balance or flexible hours.

Understanding how much employee benefits are worth often involves understanding the cost and weighing up the personal value these benefits have to you.

Health Insurance Costs

Your health insurance is one of the most significant components of your benefits package, and it is vital to understand its value and coverage.

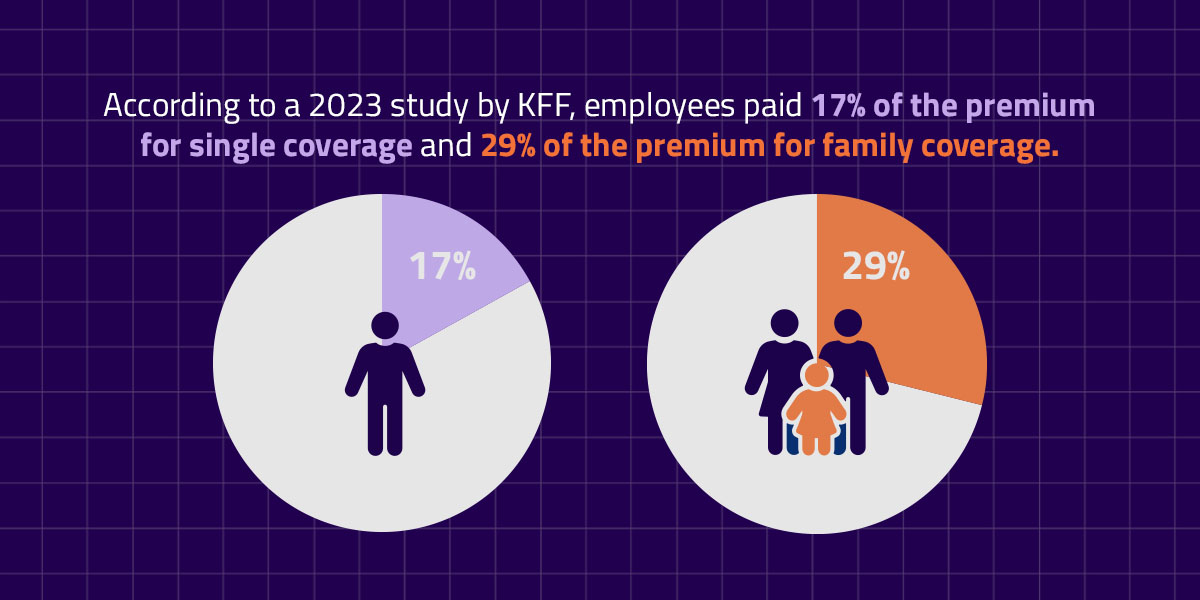

The value you get out of your health insurance will largely depend on the plan your employer has you on. These plans can range from covering the bare minimum to being exceptionally comprehensive. According to a 2023 study by KFF, employees paid 17% of the premium for single coverage and 29% of the premium for family coverage.

Of course, you should also consider your copayments to understand the total value of your health insurance. At The Difference Card, we aim to help you reduce out-of-pocket health insurance costs by providing custom-tailored benefit accounts funded entirely by your employer, which helps you get the best value out of your health insurance.

Retirement Plans

Apart from your health insurance package, a retirement savings plan is one of the most important benefits to consider. The worth of your retirement package will depend on the type of retirement plan your workplace offers you. Retirement plans can be worth up to 10% of your salary.

Leave Benefits and Paid Time Off (PTO)

Your workplace will typically offer some form of leave benefits. This may include paid time off, paid or unpaid sick leave, family leave and parental leave. You can calculate the value of your vacation time by knowing your hourly rate and using that to understand that value in the total number of hours you have in paid leave.

Lifestyle Benefits

A healthy work-life balance may not be what springs to mind when considering employee benefits. This is probably because it is invaluable — but don't disregard this vital benefit if you are ever considering a position or negotiating your package!

Lifestyle benefits that help you have a better work-life balance or better work environment can significantly contribute to your job satisfaction, productivity and motivation, and longevity in your career. These benefits can include perks like flexible hours, work-from-home or hybrid options and access to facilities like a workplace gym.

While calculating the worth of these benefits can be a little more layered, some considerations can help you assign monetary value to lifestyle benefits:

- Fuel savings if working from home or working hybrid.

- Time savings if working from home or working hybrid.

- Out-of-pocket savings for free or discounted gym membership.

Frequently Asked Questions (FAQs)

Learn more about the importance and value of your employee benefits by exploring these frequently asked questions:

How Much Are Benefits Worth in Salary?

If you are already with a company, you can easily see what your benefits are worth financially. Some of your benefits should be listed on your paycheck and will have a monetary value assigned to the benefit. This monetary value will never be in the form of cash, but shows what the employer contributes on your behalf for you to enjoy these benefits.

It is also important to remember that even though some of your benefits have a value assigned to them and may be included in the total value of your reimbursement package, they are separate from your salary, and it is a bit like comparing apples to oranges.

Why Is It Important to Have Good Benefits?

It can be tempting to think of your benefits as "perks," but they are so much more than that. Benefits are integral to the transactional relationship between you and your employer, as they can comprise a fair percentage of your total compensation. Additionally, a good benefits package can improve your job satisfaction and be the difference between short- or long-term commitment to your position.

What Are Steps I Can Take to Assess My Benefits?

Assessing the worth of your employee benefits can be easier than you initially realize! Remember, your assessment will only be a relative estimate, not an absolute figure covering your benefits, because some benefits, like flexible hours, cannot have an exact value assigned. For a basic assessment of your benefits, you can take the following steps:

- List all your benefits.

- Compare these benefits to others on the market.

- Assign a numerical value to the benefits you can find a market comparison for.

- Tally the values.

- You can also use an employee compensation calculator for greater accuracy.

- Remember to consider the value of additional benefits like work-life balance or exceptional workplace facilities!

You can also explore your providers for additional insights. With The Difference Card, you have a portal dedicated to member resources and tools. Our comprehensive member welcome kits and educational resources make it easy to understand your benefits. We also have convenient member services that allow you to contact us directly via phone or live chat. Our friendly teams are always ready to answer any questions and help you know what your health benefits are worth.