Do I Have a Good Benefits Package?

Table of Contents

Benefits play a significant role in employee stability, happiness and retention. The best benefit packages attract top talent and increase retention rates, which translates into success for the company and employees.

What Benefits Should You Look for in a Job?

Research shows that 82% of employees would feel a greater sense of overall stability if they understood their benefits. Here are the top six benefits of a job that employees should evaluate:

1. Health Insurance

Most employers provide health insurance benefits to varying extents. Typically, they offer employees a health maintenance organization (HMO) and a preferred provider option (PPO).

An HMO means the individual may only visit doctors who are contracted to that insurance company. If the user has a preferred family doctor, check that they are included in the contracted physicians for that area. HMOs are typically more affordable, but users will have to be flexible with the choices of medical care centers.

A PPO is more flexible than an HMO in terms of provider options. The insurance company still has linked physicians, who are in-network. However, the person can see a doctor who is out-of-network. They'll receive reduced coverage and have higher out-of-pocket expenses, but there are fewer restrictions.

There are three main facets to consider when analyzing medical insurance offerings:

- Employer's percent contribution: Understand the percentage of the monthly premiums the employer will cover. This amount generally depends on budget constraints and company policies.

- Plan design: This includes co-pays, deductibles and maximum out-of-pocket amounts. Employees prefer these amounts to be lower, but the employer typically decides what type of plan to deliver.

- Tax strategy: A health savings account (HSA), health reimbursement account (HRA) or medical expense reimbursement plan (MERP) can be an effective tax strategy that allows employers and employees to fund healthcare within a tax advantage account.

Companies prioritizing healthcare have a lower turnover rate because employees understand the importance of a work environment that cares about their health.

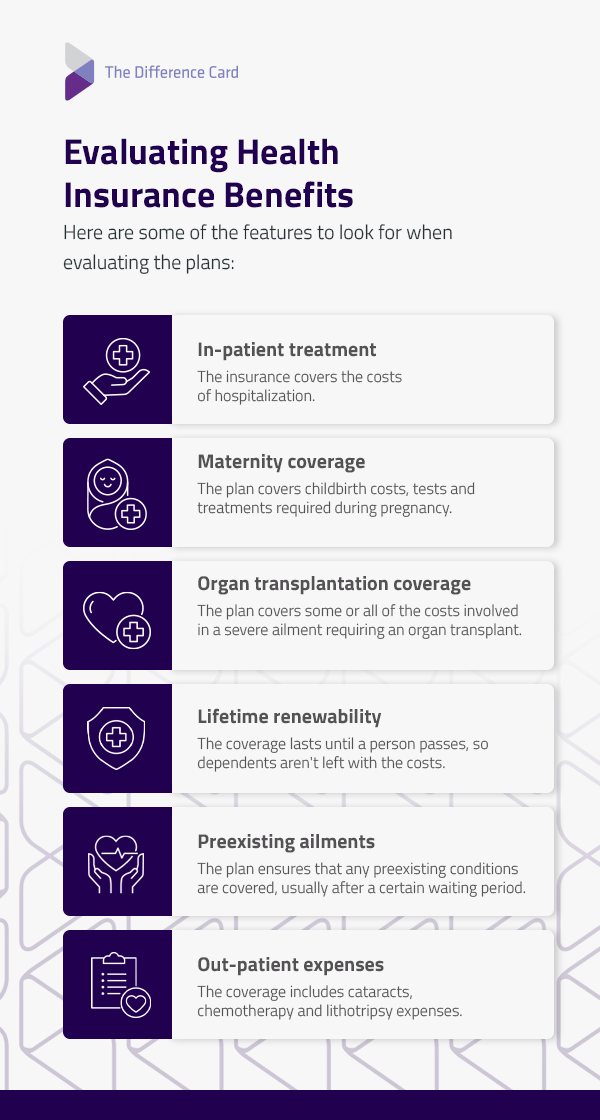

Evaluating Health Insurance Benefits

Health insurance benefits aren't all created equality. Here are some of the features to look for when evaluating the plans:

- In-patient treatment: The insurance covers the costs of hospitalization.

- Maternity coverage: The plan covers childbirth costs, tests and treatments required during pregnancy.

- Organ transplantation coverage: The plan covers some or all of the costs involved in a severe ailment requiring an organ transplant.

- Lifetime renewability: The coverage lasts until a person passes, so dependents aren't left with the costs.

- Preexisting ailments: The plan ensures that any preexisting conditions are covered, usually after a certain waiting period.

- Out-patient expenses: The coverage includes cataracts, chemotherapy and lithotripsy expenses.

2. Mental Health Resources

Mental health awareness is crucial in the workplace. A study by the American Psychological Association (APA) found that nearly 59% of employees experienced negative impacts of work-related stress.

An employee assistance program (EAP) can be part of the benefits package that companies offer employees. It provides workers with access to resources such as mental health services, family counseling and referrals to other professionals.

Some companies may also offer benefits like massage, chiropractic services or counseling on-site to help employees actively take care of themselves. Find out what mental health benefits are included. In addition to EAPs, also look for the following mental health resources as part of the employee benefits:

- Awareness campaigns: These initiatives create work environments that break mental health stigma and unpack symptoms, treatments and tips.

- Mental health days: Companies that encourage employees to take paid time off (PTO) days for mental health reasons show they care. These mental health days don't typically require an advanced booking.

- Wellness activities: On-site yoga or meditation classes or educational resources on wellness show the company values employees enough to build wellness events into the work environment.

Evaluating Mental Health Resources

When weighing out the value of mental health resources, consider the following factors:

- Employee wellness programs should be multi-faceted and focus on the physical and psychological aspects of mental health.

- These resources should be available online and should be inclusive.

- Mental health resources should focus on a diversity of circumstances.

- Companies should provide ways for employees to socialize and connect as part of mental health programs.

3. Ancillary Benefits

Ancillary benefits are supplemental benefits employees can receive in addition to their wages. They typically don't cost much on their own, but they add up in a package.

The type of ancillary benefits an employer offers depends on the nature of the work. Here are the common types:

- Dental: Dental insurance plans don't typically vary much. Ask employers what percentage they contribute to premiums and determine if it also covers dependents.

- Vision: A vision plan covers frames and contacts. Heath insurance generally covers eye tests and other eye health concerns. Typically, employers don't offer full coverage for vision, but they may cover a significant percentage.

- Disability: Short-term disability is most commonly applicable to people who give birth but can also be needed after major surgery or a serious injury. Long-term disability coverage is rarer, but it's an impressive benefit.

- Life: Life insurance offers peace of mind and security for dependents. While some employers do offer it, employees should always consider taking a separate life insurance policy to cover unforeseen circumstances.

Evaluating Ancillary Benefits

Determining whether ancillary benefits are worthwhile involves considering the following points:

- Current health status and lifestyle needs: Consider family history and current health conditions. For instance, vision insurance would be an incredible perk if vision problems already exist or run in the family, vision insurance would be an incredible perk.

- Limitations and exclusions in policies: Some may not cover preexisting conditions or have extensive waiting periods.

- Coverage extent: Check how much the ancillary benefits cover. For instance, check if dental care covers orthodontics.

- Flexibility and portability: Find out if the insurance can be maintained in the event of switching jobs or relocating and if the cover can be adjusted.

- Out-of-pocket costs: Consider how ancillary benefits will affect monthly premiums.

4. Leave and PTO

Time off is pivotal for mental health and preventing burnout. PTO policies differ, but there are two major types:

- Consolidated leave package: This type groups sick leave and PTO together.

- Non-consolidated leave package: This type provides a set amount of paid sick leave days in a term and a specified number of paid vacation days.

According to the International Foundation 2024 survey, 54.2% of employers offer non-consolidated leave packages. If you're a parent, finding out about parental leave options is important. As part of these packages, 57.6% have paid parental leave as a separate offering, while 2.7% include it as part of the PTO bank.

The Family and Medical Leave Act (FMLA) regulates non-paid and time-off policies. It ensures that employers can take unpaid sick leave to care for:

- Children, including adopted and foster children

- Severely injured active duty service members who are next-of-kin

- Spouses

- Parents

Paid sick leave policies must meet federal minimum wage laws and state regulations. Employees should be educated on available paid time off days as part of the benefits package and ensure a plan to use them if they don't carry over.

Evaluating PTO Benefits

- Develop a flexible PTO policy: Offering flexibility with PTO policies and benefits may help keep millennials and Gen Zers employed longer.

- Create a company culture-based PTO policy: A PTO policy needs to consider the employees, industry culture, the business itself and what works best for all. Encouraging time off is also crucial to making the plan work.

- Provide benefits and incentives with the PTO policy: The "use it or lose it" policy may promote taking time off, but it can also be demoralizing. Instead, employees might be allowed to trade accrued PTO for other benefits, like paying student loan debt or funding a 401(k).

5. Retirement Savings Plans

The golden years are a time for relaxing and not worrying about money. A good retirement savings plan can make those later years in life more calm. However, new generations must consider things that previous ones didn't need to. For instance, life expectancy is longer, so employees will have to prepare to either work later in life or have enough to sustain themselves for a longer time.

Here are some of the things individuals need to save toward retirement:

- Day-to-day living expenses, such as groceries

- Housing costs like mortgage and heating

- Healthcare costs

- Travel costs like gas or flights

- Life insurance

- Entertainment costs like restaurants

Finance experts recommend that the golden number for a comfortable retirement is $2 million, which accounts for the rising cost of living. There are several types of accounts employees can use to save for retirement:

High-Yield Savings Account

These accounts are suitable for anyone looking to save money for a large purchase during retirement, like a car or appliance, but who want their funds to stay liquid in the meantime. They're practically risk-free, allowing users to keep a large sum in a federally insured savings account.

However, users will likely not make much since most high-yielding savings accounts pay less than 1% interest on the total amount saved.

Traditional Individual Retirement Account (IRA)

IRAs are tax-advantaged tools that allow individuals to allocate their retirement savings steadily. Contributions are tax-deductible, so users can put more toward securing their futures.

These accounts can compound faster than other options because they increase on a tax-deferred basis, only paying taxes when they withdraw in retirement. There is a 10% penalty for withdrawing funds before turning 59 ½ years old. However, those affected by COVID-19 can withdraw up to $100,000 tax-free.

Roth IRA

Roth IRAs are funded with after-tax dollars, so there are no tax deductions, but when the user withdraws the funds, they won't owe anything to the IRS. This type of account isn't available for those who earn more than $137,000 individually or over $203,000 as a married couple filing jointly.

It's ideal for anyone under that income bracket who wants to make steady contributions that can grow tax-free.

SIMPLE IRA

These retirement accounts are ideal for small businesses and their employees. SIMPLE stands for Savings Incentive Match Plans for Employees, and it works similarly to a 401(k) since employees and employers each pay toward it.

SIMPLE IRAs lower the taxable income from both parties. All contributions grow tax-deferred until the account owner reaches retirement age.

Traditional 401(k)

A 401(k) is similar to an IRA because it grows on a tax-deferred schedule. However, it holds benefits that IRAs don't offer:

- Higher contribution limit

- Automatically paid from salary

- Can remove up to $100,000 if a spouse loses their job or the user is negatively impacted by COVID-19

Roth 401(k)

Roth 401(k) contributions come from employees and employers. Like a Roth IRA, they aren't tax-deductible, but when the user is ready to withdraw, the distributions are tax-free.

This type of account is ideal for those who expect to be in high tax brackets when they retire. It saves them from the hefty tax bill they'd have to pay with a typical 401(k).

Evaluating Retirement Savings Benefits

The ideal retirement benefits differ according to individual needs, age and position. Here are some excellent features to look out for:

- Digital access: Accessing payroll and benefits on a digital platform allows for convenient insight.

- Support: If an individual runs into plan challenges, the company should have relationship management or HR support.

- Security: Providers should have a secure data ecosystem that prevents sensitive retirement plan data leaks.

- Integrated with payroll: Payroll and retirement plan platforms should work cohesively to streamline plan payments.

6. Work-Life Balance Perks

These perks complete the benefits package. While they don't typically cost the employer much money, they show the thought and effort that goes into recruiting new employees. They play a pivotal role in helping individuals meet their needs outside work and find a balance. Here are some examples:

- Flexible schedules: Give employees the option to adapt their work hours to meet their daily routines.

- Childcare assistance: Consider offering employees childcare services so they can focus on work.

- Fitness subsidies: You could cover a portion of gym memberships or wellness activities.

- EAPs: Create spaces that offer employees help, whether it be work-related resources or mentorship programs.

Evaluating Work-Life Balance Benefits

- Equally balanced tasks: Workers' daily tasks should be equally balanced to ensure harmony in the workplace.

- Not time-consuming: Social work events should be optional and short.

- Health incentives and rewards: There should be rewards for some of the work-life balance factors. For example, employees who take the most steps can get a gift card.

How Does The Difference Card Help Brokers and Clients?

Brokers can use The Difference Card to lead clients to healthcare savings and other perks. Our high track record of success allows brokers to attain and retain customers.

With The Difference Card, you can offer clients savings of over 18% annually and a multi-year strategy that generates compounded savings. You can discuss benefits and highlight value without data and analytics. The best part? It protects your clients from unnecessary risk — they get a check if their claims exceed the guaranteed amount.

Get The Difference Card for Cost-Effective Healthcare Solutions

With over 20 years of providing healthcare solutions and up to $1 billion in savings and counting, there is no better option to streamline your clients' healthcare plans than The Difference Card. Our insurance guarantee is mastered by an A-rated division of Assurant, along with an in-house actuary and a team of underwriters.

A MERP allows employers to alter plans and split rates with employees. We pride ourselves on service excellence — we're ranked in the top 100th percentile for client satisfaction in the insurance and health plan category.

Don't hesitate to request a proposal for The Difference Card, and let us help you save money on your clients' healthcare plans without changing benefits.